You are here: Home1 / Strategy + Impact2 / Societal Impact3 / Successful Legacy Programs4 / Residential Solar Investment Program (RSIP)

Residential Solar Investment Program

Residential Solar Investment Program

Residential solar surpasses its goal a year early

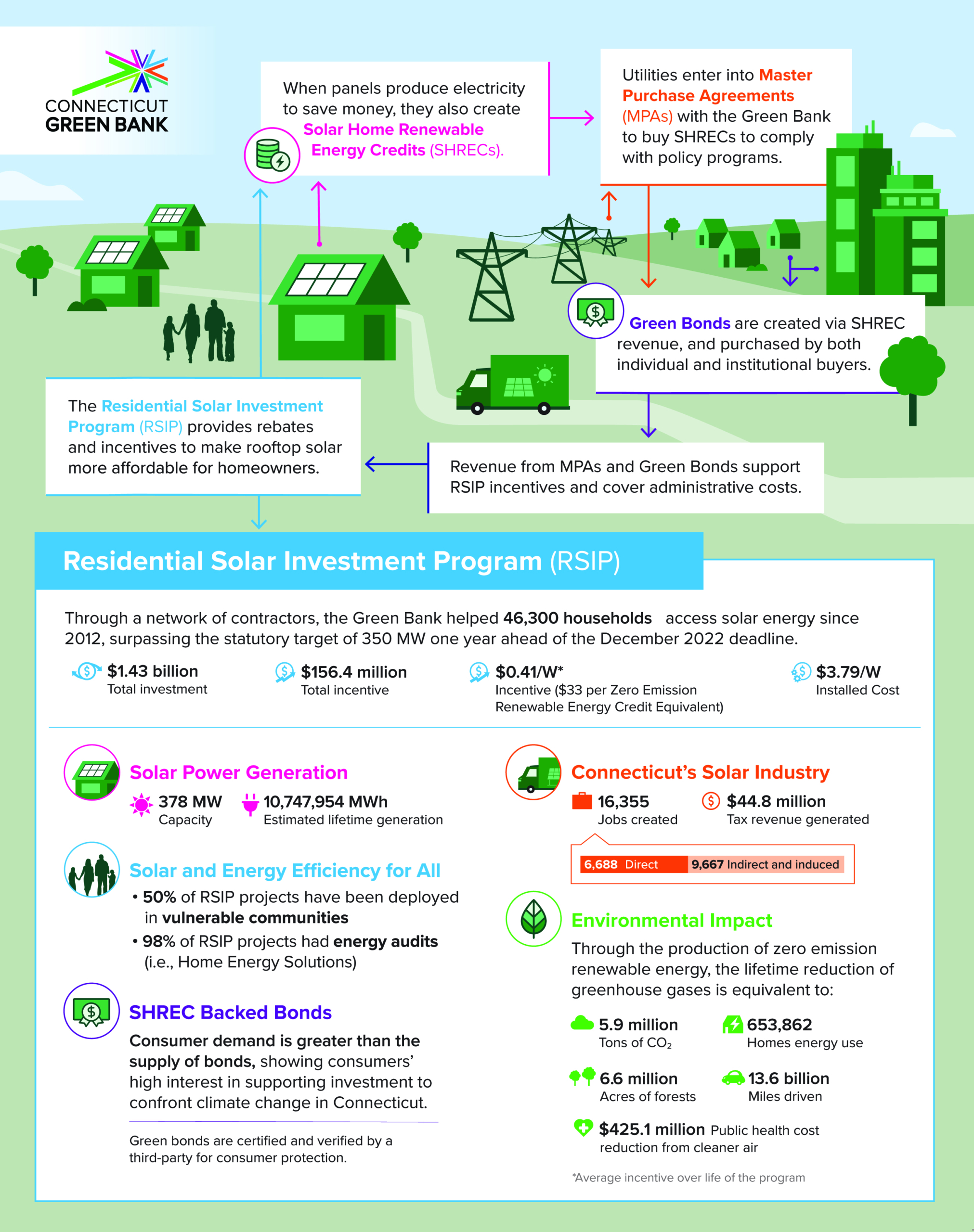

Through the Residential Solar Investment Program (RSIP), the Connecticut Green Bank, in partnership with a network of contractors and inspectors, has helped more than 46,300 households access solar energy since 2012, surpassing the statutory target of 350 MW (reaching 378 MW) one year ahead of the December 2022 deadline.

Highlights

- $1.43B total investment

- $156M total incentive

- $0.41/W average incentive

- $3.79/W installed cost

How it works

- RSIP provided rebates and incentives to make rooftop solar more affordable for homeowners.

- When panels produce electricity, they save money and create Solar Home Renewable Energy Credits (SHRECs).

- Utilities entered into Master Purchase Agreements (MPAs) with the Green bank to buy SHRECs to comply with policy programs.

- Green bonds are created via SHREC revenue and purchased by both individual and institutional buyers.

- Revenue from MPAs and Green Bonds support RSIP incentives and cover administrative costs.

Program data

Take a look at this Excel spreadsheet of residential solar installations in Connecticut for information on system costs, sizes, contractors installing systems and other details gathered during the RSIP.

Access Slipstream’s evaluation of the RSIP here.

RSIP Evaluations

The following RSIP evaluations provide assessments of the program at different time points and with different focus areas. The evaluation completed in March 2016 focused on RSIP cost-effectiveness from multiple stakeholder perspectives. The evaluation completed in January 2015 focused broadly on RSIP performance, participant and installer feedback, participant economics, inspection findings, and program cost-effectiveness.

RSIP Evaluations

Other Studies